By Eric Gaus, Chief Economist

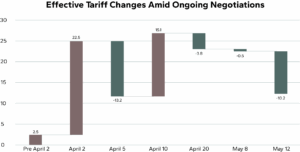

The announced reduction in trade barriers between the US and China was greeted with sighs of relief as large economic disruption will likely be avoided. The agreement walk back of tariffs to 30% on Chinese imports and 10% on US imports for 90 days. Our forecast for construction is largely unchanged since we assumed both parties would pull back. However, we are not out of the woods quite yet since supply chains are already disrupted, no permanent deal was struck, and the administration remains engaged in negotiations with dozens of trade partners.

Flows of container ships from China to the US have essentially stopped, and, much like the pandemic supply chain disruptions, this will result in shortages and inflation. In some sense, the duration of the disruption is short, but even at the peak of the pandemic restrictions, the exchange of goods continued. Another difference is that the consumer is not in as strong a position as at the tail end of the pandemic. We can expect a modest increase of inflation of a percentage point or two that will take a while to unwind.

The Fed will almost certainly need to keep interest rates restrictive to ensure that inflation expectations remain in check. Since the threat of recession is reduced, the Fed has the room to be patient in reducing rates. However, a gradual decrease in rates is likely, as the potential growth of the economy throttles back. The Fed would like to keep the degree of restriction on the economy constant, but as potential growth slows so does the interest rate at which the policy stance is neutral.

The announcement was limited to an unwinding of the sky-high tariff rates, with few other concessions announced. Uncertainty remains elevated because negotiations will not resolve fully in the next 90 days. And that uncertainty is what is currently holding back consumers and investors from making decisions. As such, developers will be circumspect in starting new projects, current projects will be delayed more than usual, and construction that has broken ground will take longer to reach completion.

The path toward resolution of uncertainty will take time. Even unilateral trade negotiations can take years to negotiate, and the administration is engaged in dozens of these discussions. Therefore, grand deals that are fully finalized and permanent are unlikely within the year. We expect that subsequent minor concessions with China and other nations will ratchet down uncertainty through the end of the year. The announcements of these future concessions will demonstrate the cooling of tensions and an increasing likelihood of stability.