by Arsene Aka, Senior Economist at Dodge Construction Network

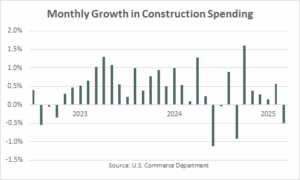

Economic uncertainty, tariffs, and the high-interest-rate environment may have contributed to lower construction spending in March. According to the U.S. Commerce Department (Census Bureau), the total value of construction put in place declined 0.5% in March to a seasonally adjusted annual rate of $2.2 trillion. Spending on both residential and nonresidential construction projects fell in March. Economists had expected a modest increase in total construction spending that month.

Spending on residential construction (including renovations) slipped 0.4% in March. New single-family construction outlays posted a meager 0.1% improvement, the fourth consecutive increase. Meanwhile, spending on new multi-family construction was flat. The residential construction sector has been constrained by stubbornly high mortgage rates, tighter immigration policies, and the latest tariffs on imported goods. The National Association of Home Builders estimated in April that tariffs could add $10,900 per home.

On the other hand, spending on nonresidential construction decreased 0.5% in March, as 11 of the 16 nonresidential construction sectors posted monthly declines. Outlays on religious construction posted the largest decline, followed by spending on healthcare and lodging. Meanwhile, spending on public safety, amusement, transportation, conservation, and water construction projects rose in March. Of note, data center construction outlays remained a bright spot, with spending up 33% year-over-year, down from 39% in the previous month, as AI-driven demand for computing power remained strong. Spending on data centers has seen double-digit year-over-year increases in each month since November 2021.

In the opening quarter of this year, construction spending stood at $486 billion on an unadjusted basis, up 3% from the first quarter of 2024. Residential construction outlays grew 3%, to $207 billion, and nonresidential construction also rose 3% to $278 billion. Dodge Construction Network expects modest to moderate growth in the total value of construction put in place over the next two years. Dodge expects three 25 bps interest rate cuts by the Federal Reserve this year, followed by an additional 25 bps cut every quarter in 2026, which will help support construction spending and starts. That said, trade policy uncertainties will lead to extremely cautious investment behavior by construction firms.